Connect to payment devices around the world, instantly.

A global, integrated processing partner for Payfacs, SaaS and POS providers.

Build your payments integration

Platform support

powering payments for

FLEXIBLE SOLUTIONS FOR YOUR PLATFORM

Our payment options and hands-on expertise are all you need to create a powerful payment experience for your customers

API integration

- A single integration to more devices globally

- Seamless instant boarding

- Modern REST APIs

API integration

- Sell Internationally, get paid in your own currency

- Connect POS to retail payments globally

- International settlements for global merchants

Comprehensive security + compliance

- Data security and encryption

- Secure payment info collection

- Chargeback management

Instant savings

- Customized Cash Discounting

- Compliant Surcharging

- Same Day Funding

Financial reconciliation + reporting

- Real-time reporting

- Unified Reporting

- Simplified Reconciliation

Customization

- Create your own Payfac experience

- Omni Channel Payment acceptance

- Custom revenue sharing plans

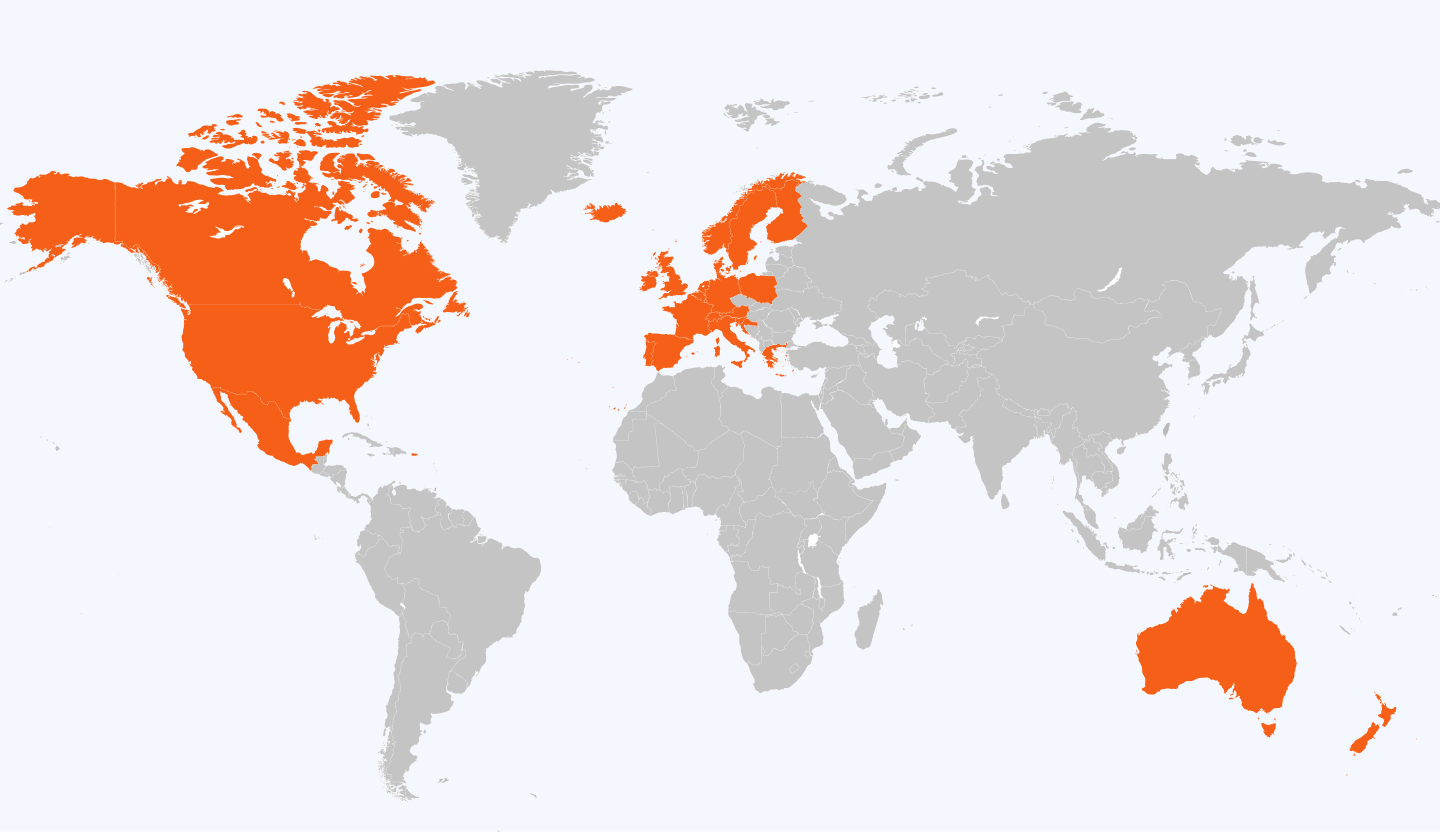

Accept more payments worldwide

Global distribution**

** We also offer full service integrated payment processing solutions in 40 other countries where our cloud based API is not available (yet).

Ready to sell like never before?

HOW IT WORKS

Open the door to integrated payments, globally.

1

Integrate to Payroc

With no access to sensitive data, our API integration removes requirements of PCI PA DSS from the POS. Once finished, you can sell locally in all supported countries/devices.

2

Web API call to Payroc

Your POS initiates a simple web call to our API. The API call is agnostic. If you can send a web-based command via the internet, you can integrate with Payroc.

3

Payroc to payment device

POS devices are connected to and managed by Payroc. With receipt of a payment command, we remotely push the command to the device with direct connection over WIFI, Ethernet and cellular.

4

Payment device approval process

The payment device will remotely receive the command from Payroc. The device will secure, accept, and process all sales with local currency, EMV or country specific payment types directly with Payroc.

5

Response from payment device to Payroc

At completion of the transaction, all non-sensitive response data and transactional data is provided to Payroc. We standardize the data and provide one universal response format back to the POS system.

6

Reconciliation, Payroc to POS, ISO, Gateway

The final step in the process is full reconciliation with the POS, ISO, Gateway or software. The client is provided transaction result data allowing for partner’s reconciliation and reporting.

TESTIMONIALS

What our customers have to say

Jared Holland

Russell Roux

Bruce Coombes

CUSTOM BUILT FOR YOU

Choose a plan that works for your business model

Affiliate

- Lean on the Payroc expertise and incorporate Payroc’s tech stack to reach opportunities and drive success through Payroc sales experts – it’s what we do best.

- Payroc handles boarding, underwriting, compliance, tech, risk & service

- Best for startup’s and referral partners

Managed Payfac

- The Payroc team will simplify and automate your onboarding, provide reporting to you or to your merchant.

- Payroc handle underwriting, risk and compliance

- Best for mid-level and established ISVs

Full Payfac

- You handle

- Payroc is hands-free

- Best for enterprise ISVs or Payment Facilitators

CHOOSE FROM A WIDE VARIETY OF POS TERMINALS

Get started quickly with the latest pre-certified terminals

Every terminal meets PCI compliance, and is either encrypted with E2EE or P2PE.

Ingenico Desk 3500

- Leverage Telium applications on the next-generation payment terminal

- Make NFC payments a seamless consumer experience

- Comply with the most stringent security requirements

PAX A80 Android Desktop

- Leverage Telium applications on the next-generation payment terminal

- Make NFC payments a seamless consumer experience

- Comply with the most stringent security requirements

Ingenico Move 5000

- Leverage Telium applications on the next-generation payment terminal

- Make NFC payments a seamless consumer experience

- Comply with the most stringent security requirements

Ingenico Move 5000

- Leverage Telium applications on the next-generation payment terminal

- Make NFC payments a seamless consumer experience

- Comply with the most stringent security requirements

Get started with Payroc

ISVs come in all shapes and sizes—from startups to established solution providers. If you develop, market and sell your own software or applications, let’s talk today!

United States

United States